NY Close Scalper V1.3 & V2.6 – [Cost $900] for free Download

Symbols: EURUSD, GBPUSD, EURCHF, USDCHF, USDCAD, EURAUD, EURCAD

Time frame: M5

Max. draw down in 16 year back test: $56 per 0.01

Please read the blog post for instructions on the way to found out the EA.

The GMT time will be different in summer compared to winter because the EA will trade around the New York close time (16:00 – 18:00 New York time) (DST: daylight saving time). However, because the EA stores daylight saving timings internally, there is no need to manually modify the trading hours.

The EA should run on a VPS without interruption (also Friday ) to store the historic data.

Please allow web requests to the following URLs for the calendar news filter and automatic GMT offset calculation:

http://fxdata.cc

http://backup.fxdata.cc

http://breaking.fxdata.cc (only needed if you employ the breaking news filter)

For backtest it is important to have the correct GMT settings. Ideally, backtests should be done with Tick Data Suite GMT+2 with US DST.

Because this approach trades around swap time, the spread is frequently rather wide. In back testing, you must utilize genuine spread. But keep in mind that at that time, the spreads between brokers are often quite different.

On days when major events occur, such as general elections in the United Kingdom, the United States, or Europe, the EA should be switched off!

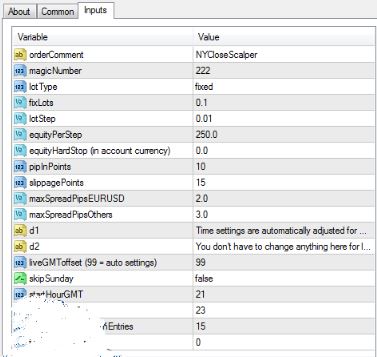

General Trade Settings

- daily Equity Stop Percentage: IMPORTANT: please read point 6 within the blog post.

- order Comment – Each trade will show this comment in history tab.

- magic Number – individual magic number. The EA will only manage position of the chart symbol with this atomic number .

- lot Type – “fixed” or “increasing”, where the lot size is calculated automatically.

- fix Lots – fixed lot size just in case lot Type = fixed.

- lot Step – what proportion the lot size should be increased every equity Per Step (if lot Type = increasing).

- equity Hard Stop – if the equity falls below that level the EA will close open positions (only of this strategy) and can not open any new positions.

- pip In Points – for 5-digit brokers, this could be 10, for 4-digit brokers 1.

- slippage Points – Slippage utilized in Order Send() function (points, not pips).

- max Spread Pips – maximum spread allowed for entry. If smaller 0, auto settings are going to be used, which are different for every currency pair.

- Time Settings

- live GMT offset – To set GMT offset manually. Usually this is not needed.

- skip Sunday – if true the EA won’t open positions on Sunday (GMT).

- start Hour GMT – when to start trading (GMT).

- end Hour GMT – when to stop trading (GMT).

- wait Minutes Between Same Side Entry– After a buy position another buy position will only be allowed after the given time. Same for sell positions. If you’re sleeping during the trading hours you’ll limit the potential total risk with this parameter. If the last hour was a loss the EA will automatically increase wait Minutes Between Entries by quarter-hour .

- don’t Trade Triple Negative Swap – If true, the EA won’t open trades on before swap Hour GMT when the swap is negative on days with triple swap rate.

- triple Swap Day – Day at which triple swap is applied. On most brokers it is Wednesday.

- swap Hour GMT – Swap hour used if don’t Trade Wednesday Negative Swap=true.

- tester GMT offset – Only needed for tester because GMT time isn’t defined in tester and your bar data may need a GMT offset.